ULIP Charge Explanation!

![]()

Hemi a tawp ber hi han en vang vang la.. Internal rate of Return atangin an chhut tih i hmu thei ang.

A awmzia chu… Kumtin Rs.100 premium atan i pe char char a, Kum 10 chhung atan; I pawisa dah hi kumtin 10%p.a in alo pung bawk ani. Chuan a khawlkhawm zat chu; Rs.1594/- a ni.

Mahse hemi zat hi an pe dawn lo che a, charge neuh neuh an deduct hnu ah chuan Rs.1515/- hi i dawn tur tak a ni.

He an charge zat hi Internal Rate of Return hmangin an chhut ta a.. 10% pung char char kha.. I tan chuan 7.43% chiah pung ang a ni ang. Internal Rate of Return (i.e 7.43%) tam a piang hi an charge tlem tihna

(Internal Rate of Return chhut dan hi a buaithlak deuh, Financial Calculator nen a inhrilh fiah loh chuan a tih dan a om vakin ka hrelo)

A lem atanga a hmasa ber hi han enla.. ULIP zinga charge tlem na ber : Plan – ClassicLife Premier

Insurer – Birla SunLife tih khi i hmu anga.

A awmzia chu, Kumtin 10% interest nei se, an charge zat chu kumtin 10% atang hian kumtin 1.93% hi I capital pung atang khan an ei char char tihna ani. Chuan a bak zong 8.07% khi i interest neih dik tak!!

A lem atanga a tawp ber AvivaLife ho Plan : LifeSaver khi han en leh la; I interest neih 10%p.a anih chuan, 3.91% (10-6.09) hi kumtin an charge sak che. Chuan i interest neih diktak chu 6.09%p.a (10-3.91) a ni. [ Interest 15%p.a anih pawn 3.91% tho kumtin an eisak/charge tihna, chuan i interest diktak chu 11.09%p.a (15-3.09)] (Hengho hi a charge tlemna list anni a.. a tlangpuiin 2%-4% kumtin I interest hmuh/neih atangin an cut sak ang che..)

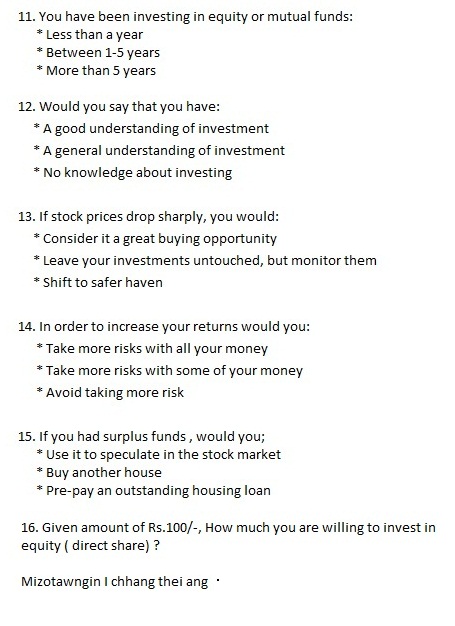

“As per estimates by brokerage firm Edelweiss, for a typical back-loaded policy, the difference between gross and net yields to the policyholder ranges between 2.1 per cent and 4 per cent. This difference, according to Edelweiss, is likely to be higher for high charge front-loaded policies (4-4.5 per cent).”

Hemi awmzia chu.. ULIP typical back-loaded ( Yearly premium, Half yearly premium, vawikhata premium pek nilo, kumtin pek ngai chi) ah a tlangpuiin 2.1% atanga 4% thleng I interest neih atang khan an deduct thin tihna..

Entirna: Khimi a charge tlem berna BirlaSunlife ho scheme, ClassicLife Premier khi han en vang vang la… i interest neih 10%p.a anih chuan 1.93%p.a an deduct tihna a ni..

Chuan a interest khi 15%p.a anih chuan, atlangpuia lakin i interest rate neih diktak chu (15% – 2.1%) 12.9%% atanga (15%-4%) 11% tihna ani ang.

India ram ULIP a charge tlemna ber (BirlaSunlife’ classiclife premier) ah pawh kumtin i interest atangin 1.93% an deduct char char tihna ani.

ULIP ah re re, kum 3 atanga kum 5 thleng i khawltlin loh chuan khitiang zat aia tam khi i chawi angai tihna, a tlangpuiin kum 3 khawl thlen pawn Ila loss thei hle ani. Kum 5 chin atang hian khitiang kan sawi tak charge khi applicable chiah

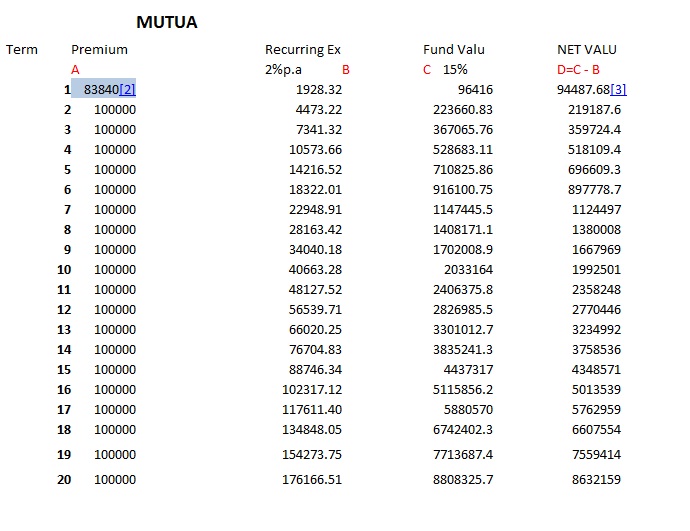

ULIP Vs Mutual Fund+ Term Insurance Part-2

Fund Value(NAV) atanga Expense deduct hnu amount (Net Value) hi Next Interest Calculate na tur.

Mutual Fund 1st Premium atang khian Term Insurance 5 lacs of 20 yrs cover and 20 lacs SA leina zat (Rs.16,160) kan deduct

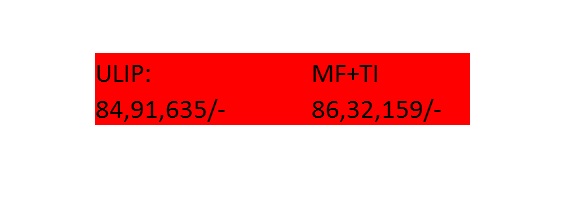

ULIP Vrs Mutual Fund

ULIP Vs Mutual Fund

Mizoram ah ULIP hi invest-na hmanraw tha ber thaw thangin an chhuah thin. A chhan ni thei bera ka rin chu, ULIP ah hian agents hlep atam ber vang leh an hriat loh luat vang a ni ve thei bawk ang.

Tun Health Care Scheme te pawh kha, an hriat loh luat vanga ULIP-a dah annih ka ring deuh thut thut ta mai, an vua leh vang ten agent commission an chan dawn avanga han dah ngawt kha a chhan ber ni turin sorkar level-a rel fel ani si ( hemi chungchang ah hian officer lian te nen an committee hial si a). Chutah ULIP anih miau avangin charges chi hrang hrang leh a hming pu tu tur (Policy Holder) angai, a hming putu kumzat azir hian charges ala awm leh (Mortality Charges).

Hemi mortality charges ber hi a thlawna luang ral, trul miah lo, Pu Tlanga te khin thlak theihna hial khawpa pawisa sen ngai a ni tlat. A chhan chu anlu man liau liau, lak let tur awm tawh lo.. an dam rei poh leh pek tur tam ting mai a ni. Tin, hemi bakah hian 30-60% vel an pawisa hlawm dah atangin an cut sak leh thin. Rs. 1,00,000 i dah chuan an invest sak tur che chu a tam berah Rs.70,000 chiah a ni. Thenkhat in a tirah cut tam viau mahse kan lo vanduai anih hlauh chuan pawisa tiam sa (sum assured) kan la let thei dawn thova anti thin. Anih na tak kan chhut chhin ang.

Mutual Fund ah, ULIP te aia performance nei tha leh rintlak an tam khawp mai, Investment ngawr ngawr an aim a nih chuan. Anih loh pawn ULIP a luman veng zat(thih thuta pawisa dawn tur ang chi kha) nei reng chung hian return tha zawk tak a neih theih. Hetiang hian, ULIP a invest in luman(Sum assured) aneih avanga sen ngai chanve aia la tlem zokin Mutual fund a neih theih bawk.. ULIP ah Rs.2,00,000-3,00,000 velin luman Rs 25 lacs anlei tlangpui ang hi, Mutual fund ah i duh tel ve anih chuan Rs.1,00,000 hnuai lam hian a lei theih tho. Engtin maw? SBI Life, LIC etc atangin Term Insurance i lei tel mai ang chu.. An sen chanve lek sengin. Hetiang chiah hian Endowment Plan antih ho ah pawh hian phakar a chhuah theih.

HEMI CHIN HNUAI LAM HI KA THUSAWI FIAH DUH TAN. HRIATTHIAM A HAR DEUH ANG 🙂

A nihna tak, an performance leh an cut zat zawng zawng te chhut leh cut vekin kan dah lang ang e. Sawi ngawt hian a chiang thin lo.

Kum 25 chhung invest tur angin chhut ila.

ULIP atangin; Bajaj Allianz’s UNIT GAIN PLUS (GOLD)

MF(Mutual Fund) atangin; Reliance Regular Saving Scheme- Equity

Anni pahnih hi a ti thra, anmahni line of business(ULIP & MF) ah Top 5 tling ve ve an nia, an kum 3 performance lo neih tawh atangin kan chhut chhin ang. Amaherawhchu ULIP ah hian kan khawl tlin hman hmaa kan lo vanduai chuan Sum Assured antih mai, min pek zat tura an bithliah lawk a awm bik a, hemi tak hi MF a kan neih ve theih nan TERM INSURANCE kan lei tel angai ve tihna ani, MF a kan invest-tur sum kha kan pawh hek deuh angai phawt.

Rs.5 lacs invest ve ve turin chhut ila, Chuan kan lo vanduai anih pawha kan sum lak tur bithliah (Sum Assured) ah khan Rs.25 lacs kan ti leh anga (ULIP ah hian Pawisa invest let-nga a tam hi Sum assured atan an hmang tlangpui).

Mutual Fund ah Term Insurance kanneih tel ve angaih avangin(ULIP in anei bik si a) Term Insurance Rs.25lacs vanduai palh liau liau-a min pe thei tu tur LIC hnen atangin kan lei ang. Kum 25 hi kan invest chhung tur kan ti a, chuti a nih chuan Kum 25 chhung zawnga kan lo vanduai palha Rs.25 lacs min pe tur atan LIC hnen atang Rs.84,500/- in kan lei angai ta phawt. Kan invest tur sum kha Rs.5 lacs kan tih tawh kha, Hemi kan lei avang hian Rs.5 lacs ni tawh lovin Rs.4,15,500/- ah a tla thla ta phawt. Eeee ava hlawk lo bik ve i tih chuan a hnu leh hi lo en kar rawh. 🙂

A tir pawisa dah luh atang hian ULIP ah 30-60% vel an cut thin kan tih tawh kha, a tlem thei ang berin 30% hi cut tir ila. Chuti anih chuan kan invest tur (ULIP-ah) sum kha Rs.5 lacs ni tawh lovin Rs.3,50,000 ani tawh ang.

Mutual Fund-ah a tira cut hi atam berah 2.25% ani thin. Chuan Term insurance kan lei hnu-a la bang Rs.4,15,500/- kha alo tla hniam ve leh anga, Rs.4,06,151 ah. Chuan kan pawisa dah Rs.5,00,000 atang khan; ULIP ah chuan Rs.3,50,000 an invest anga, MF ah Rs. 4,06,151 an dah lut ve thung ang. A tir cut awm zong zong paih vek hnu ah hemi zat hi keimahni hmingin an invest dawn tihna a nih chu. A tir kan sum chan zat khi Rs.56,151 in a inthlau ta phawt (MF ah chan atam zawk tihna).

An performance hi date 10/07/2006 atangin teh tran ila:

ULIP;

Unit Gain Plus-Gold —

NAV as on 10/07/2006 ———– 10.00

NAV as on 28/07/2009 ———— 17.019

Kum 3 chhunga a return —- 70.19% ( Kum tina a punna rate — 19.39%)

Mutual Fund;

Reliance Regular Saving Scheme—

NAV as on 10/07/2006 ——— 11.0910

NAV as on 28/07/2006 ——— 22.8182

Kum 3 chhunga a return —– 105% (Kum tina a punna rate —- 27%)

(Kumtina a punna hi CAGR-Compounded Annual Growth Rate hmanga chhut ani)

ULIP atanga kum tina an charges thin;

ULIP;

Fund management charges: —- 1.75% per annum

(ULIP kumtin punna 19.39% khi, he 1.75% kumtin anlo charge ve avangin a tlahniam ang.. 17.64% ani tawh ang)

Mortality charges – Kum 30 atanga invest tan ni se, kum 25 chhung a invest hnua an cut tur zawng zawng Rs.1,95,875/-

Policy charges —— Rs.600 per annum.. chuan kumtin 5% in a pung ziah bawk anga, kum 25 hnu-a an charges zawng zawng chu Rs.28,636/-

ULIP atang kumtin 17.64% a apun char char hnu-ah hian, a chung ami 2, mortality leh policy charges khi kan pek chhuah leh tur a ni. Chuti anih chuan kum 25 hnu-ah cut tur zawng zawng cut vek hnu ah Rs.2,00,96.412/- a ni ta!!!

Mutual Fund atanga kum tina an charges thin;

Fund management charges: —– 1.25% per annum

(M.F ah kumtin 27% a pung kha he 1.25% kumtin anlo charge ve avangin 25.75% ah a tla thla ve phawt)

AMC’s Recurring Expenses ———— 2.50% p.a

He thil 2.50% kumtin anlo cut avangin kan interest rate neih dik tak chu 23.25% (25.75%-2.5%) ani tawh ang.

Kum 25 hnu-a a pung tur zawng zawng chu; Rs. 7,55,71,966/-

MUTUAL FUND TAM ZAWK NA : Rs.5,52,51,043/-…

Han en vang vang teh, a inkhawl hnem hleih zia hi. ULIP ah chuan Life Insurance chu-e-kha-e anti thei tohlo, ULIP in Luman a pek theih ang hi heti zat khawlkhawm tam zawk chung hian annei ve dawn tho. Chuvangin aww kan unau, bum nawm-in lo awm tawh suh… Ka Lawm e.

Zawlbuk Real Estate

Zawlbuk Real Estate chungchang ah hian zawhna ka hmu thin mai ni lovin ka dawng thin a, Ka ziak hreh deuh hlek thin, mahse ka mutheilo (mu theilo lehpek) in ka ngaihtuah chet chet hnu in “aaa ziak pawp mai teng, anih na tak hriat hi tu tan pawh a tha zawk e” ka ti ta a. ‘Un-Professional Code of Ethics’ kan bawhchhe riau riau ang tih te pawh ka hlau hlel love, han professional lem lo mahila ![]()

A nihna tak chu hei hi a hi e. A LEM anni lo. Sub-Broker angin Mizoram ah an operate berin ka hria. An business run dan (inziah dan tlangpui) ah chuan anmahni hian an va deal a ang ber. Property dealer ang deuh in. Mimal, society etc. te tan an inhmun, commercial place tur te lo zawn saka, enge hlawk ber anga tih lo zawn sak tu an ang deuh ber. Chutiangin a hralh duh te tan pawh.

Mahse, Mizoram ah chuan hetiang ti ta lo hian, sum an khawnkhawm ringot hian mi rilru a tibuai ta ber niin a lang. Real estate investment ah hian chi 2 a awm a: 1. Direct property Investment ( Anmahni in building, plot, etc te leiin a pung tur beisei-na nen anva invest ang). 2. Indirect property investment ( Mutual Fund ang deuh hian, hetianga hlawkna pe thei tu tur lo zir chianga, sawrkar hriatpui-na nena pawl indin ah te ava dah theih leh).

Hetah hian a 2-na hi India ramah ala awm ve tlat lo. A khawi inhmun, ram, building hian nge hlawk-na pe thei anga, enge reliable ber ang tih lo zirchiang tu tur, sawrkar registration nei leh sorkar regulate thlap an awm ve lo. Chuti a nih chuan zawlbuk real estate hian anmahniin (Direct Investment) an run ve tawp angai tihna.

Real estate investment Trust (REIT) anti maia, ram dang (India nilo) ah chuan an hmang deuh fur tawh a ni. Anni hian stock market-a in register company ten a share ang zawnga an pe chhuak ang hian mipui tan antih sak thin. Tuna Zawlbuk real estate tih danah chuan anmahni hian an rin zawng leh a pung tha tura an rin ho ah pawisa an zuk invest tawp (Inhmun, nakina apung beisei rana i lei anih chuan investment anga chhiar a ni) mai ni berin a hriat. Entirna:

Aizawl veng thenkhat, in luahman leh inhmun pun chak em em na bik (E.g Zarkawt, Chanmari etc) ah an pawisa khawnkhawm hmangin anlo lei then ve ta a, a floor khat/hnih chauh emaw, a building tawp emaw, a hmun(plot) chauh emaw. Chuan Inhmun/luahman etc. a lo to chuan a hlawk-na kha an pawisa puk-na te hnen ah an sem darh ve leh ta thin tihna anih chu. ( Anni hian heta tang hian Ei an nei ngei bawkin a rin- awm, MF angah chuan a hlawk-na an hmuh ang ang an sem chhuak leh vek)

Heta ka sawi duh pakhat chu, a risk a sang em em. An zuk invest na hi mimal leh pawl, company etc te inhmun leh building velah ani maia. An market practise danah hian sawrkar in regulation mumal ala neilo zui (An duh dan leh rilrem zongin an chalai thei tihna tluk ). A market tur lo research tih velah pawh tute nge lo titha tawh, tute nge past performance tha deuh ti-a han chhui zui tur an awm ve tlat lo( Mutual Fund leh Insurance ULIP te angah chuan an past performance a zirin pawisa zuk dahna tur kan thlang tlangpui thin).

Direct investment ti mai ila, real estate company lian (DLF, Unitech etc.) ah te an share leia invest pawh hi a risk a sang bon top. Tun market tlak vak lai pawh hian 60% velin an tla dawrh bik mai ni. Chutah Satyam Scam ( Book of Account atanga mipui leh regulator aka SEBI a lo bum reng na kha) atang khan Real Estate Company ho hi rinhlelh-na a nasat em avangin an tla leh rawih rawih bawk. (Satyam scam hma-in DLF share Rs.1100/- vel a ni a, Satyam scam hnu deuh kha Rs.125 velah a tla rawk2 mai ani). A chhan chu an book of account hi access theih a ni tlat lo, anmahni chuan a dik loh-na a awm hran lo, chu ti khati anti ve bawka, India ram expert leh FII ho rinhlelh an la kai tlat.

Chuvangin REAL ESTATE INVESTMENT hi risk la sang ngam lo tan chuan pan chi a nilo.

Aam Admi Bima Yojana (Aam Admi) hi enge?

Social Security Scheme (Insurance) peng pakhat a ni a. Hemi hnuai ah hian kuthnathawka eizawng tute tan tih bik a ni. Landless hi anti deuh kher a, Mizoram ah chuan BPL tan lak theih turin sawrkar hian a ruahman thei a ni. State sawrkar kaih hruaina hnuai ah agency siamin a din theih bawk (Mizoram ah din ala nilo).

Chhungkaw eizawng tu ber, pa ber emaw, nu ber, tlangval neih chhun etc an boral emaw, hnathawk thei lova anlo awmin he scheme hian a thlawn liau liau in Rs. 75,000/- a pe thei a ni. Chutah chumi vanduaina tawk te fa (mipa leh hmeichhia) ten an zirlai an chhunzawm theih nan thlatin Rs. 100 ve ve, a tam berah fa pahnih tan pek a ni bawk.

NLUP sum kan beisei sup sup khawp hian he thil hi beisei ve chi a ni khawp mai. A premium ti mai ila, hemi cover neih theih nana sum thawh ngai hi Rs.200 per person chiah a ni, chutah 50% hi state sawrkar thawh tur, a dang 50% hi central Sawrkar, a cover te ber thingtlang lo neitu bak berh tak tak ten cheng khat pawh an thawh a ngai loving.

Hetiang hi kan sawrkar hian ngaihven deuh se a lawmawm khawp ang. Tin, henglo pawh, State sawrkar contribute tur scheme hrang hrang hi a tam khawp mai. NLUP ah Rs.1,00,000/- an phal ta rau rau, chhungkaw khata Rs.100 thawhsaka an vanduai na tawh palh huna Rs.75,000/- anlo dawn ve na tur ngaihtuahsak hi sawrkar tih makmawh a ni e.

Pension

Tunhma leh tunhnu ata kan upat hnu a kan inghahna tlangpui hi fate ah a ni deuh tlawng hlawm awm e. A him tawk loh zia leh fate tan phur rit mai kan nih theih zia te ngaihtuah chet chet ve a hun tawh.

Kan fate hian an nupui fanau te tan an thawhchhuahsa pawh an indaih tawh loh nak laia kan lo la tibuai fo hi a tibuai thin tu leh la tibuai thei mai tur te hian ngaihtuahna dang i siam ve tawh ang u.

Mi ram sawrkar hausa te ang kan ni mawlh silo. America ram ang te chuan social security scheme an nei tha em em, pension plan mumal neilo te pawn an fate tibuai lo zongin an pension hun an hmang thei tlangpui.

Keini hetiang hi kan sawrkar chak tak, nge pachhe tak zawk hian min tih sak ve thei silo, nge min tih sak na chang an hre ve lo. Kan neih ve chhun tur ber pawn kum 3 pawh a daih meuh silo (Mizoram health Care scheme).

Sawrkar hnatawk (State & Central) ami te hi chuan an pension tur an duhthu vang pawh ni lovin an khawl ngei ngei angaia, an tan chuan innghahna ala awm deuh. Mimal leh private-a inhlawh leh hnathawk te hian kan ngaihtuah chian a ngai khawp mai.

Sawrkar hnathawk bik lo en phawt ang.

Anni pawh hian hetiang benefit hi annei rei thei tawh bik lovang. Tuna an neih danah chuan thlatin a tlem ber ah 6%(thlatin hlawh) hi an thawh ziah tur a ni a, an thawhzat chiah hi sawrkar in ron thawhpui ve in atam berah 12% (monthly salary) thleng an thawhpui.

An pension huna an pawisa thlatin dawn tur hi an khawlkhawm tling emaw tling lo emaw an dawn tur bithliah chu an dawng tho tho thin. Hemi tak hi sawrkar tan a luhai thlak em avangin Defined Contribution Plan an tih mai, an pawisa thawh/khawlkhawm zat leh interest an neih mila pension dawng tawh tur hian ruahmanna a kal mek a ni.

1st January 2004 atanga central sorkar hnathawk te chuan NPS(new pension scheme) an tih hi an zawm angai tawha. Heta an pension dawn tur hi Fixed ni tawh lovin an khawlkhawm zat leh sawrkar thawhpui, an khawlkhawm interest chiah hi pension atan an dawng tawh dawn a ni.

An khawlkhawm tlin loh chuan anmahniin an tuar tawh anga(sawrkar atang beisei tur a om toh lo), an pelh deuh leh an tan hlawkna. Hemi kal dan phung hi state ah leh private establishment ah hman tan tum mek a ni. 1st May 2009 atangin NPS pawh rampuma hman tan tura chhawpchhuah a ni a, Engtik ni ah emaw chuan state sawrkar te pawn anla zawm ngei ngei hun a awm ang.

Tuna pension an lak thin atang pawh hian an in enkawl thei tawk tawk emaw a ni a, A tlangpuiin an pension hma senso 50-75% vel hi an mamawh tlangpui tawh thin pension hnu lamah hi chuan. An pension dawn, thla hnuhnung ber-a an hlawh lak chanve vel hi anla tlangpui (A chhutna tur formula a awm). An GP Fund hi an hman thiam loh phei chuan an pension hun hi indaih lo chungin emaw, harsa tak chunga an hman angai ve tho.

Private Company etc. a thawk te tan:

Mizo te he lama thawk kan la tlem deuh avangin sawi thuak thuak ringawt ang ![]() Tuna hman mek EPF( Employees provident Fund) ang chuan an thlatin hlawh 12% an contribute thei, hemi zat chiah hi an employers ten an thawhpui ve ang. ‘Marawhchu a tam berah Rs.6500 hi an contribute thei. hemi aia tam an thawh duh a nih chuan employers ten a pelh-na chu an thawhpui tawh lovang.

Tuna hman mek EPF( Employees provident Fund) ang chuan an thlatin hlawh 12% an contribute thei, hemi zat chiah hi an employers ten an thawhpui ve ang. ‘Marawhchu a tam berah Rs.6500 hi an contribute thei. hemi aia tam an thawh duh a nih chuan employers ten a pelh-na chu an thawhpui tawh lovang.

Heta tang hian employees pension scheme an ti chhawng leh, employers contribute 12% atang khan 8.33% hi pension atan bik an dah lut ang, a bak 3.67% hi chu EPF ah khian a thawhpui ve ang ( employees te contribute hi chu EPF ah chiah a lut, pension fund ah a lut ve lo). Hemi bakah hian central sorkar in 1.16% pension atan bik hian a thawhsak bawk. Entirna nen sawi chhin ang:

I thawh zat Rs.6500

Employers thawhpui che 12% of rs.6500

EPF a lut tur (3.67% of 6500) = 239

Pension fund-a lut zong(8.33% of 6500) = 541

Central sorkar thawhpui (1.16% of 6500) = 76

I pension fund-a lut zong = Rs.617

I PF a lut zong = Rs.6739 (6500+239) Heihi maximum ka tih tawh kha.

Interest rate hmanlai mek hi 8.5% p.a a ni. Pension tur i khawlkhawm tlin loh chuan a pawi bon ni ringawt. Nangman pension scheme dang pawh i thlang thei tho, employers contribution nei tho turin. ‘Marawhchu recognized annih erawh angai ang.

Self Employed Ho tan:

Hemi te tan chuan chuan PPF (Public Privident Fund) a awm.Mizo te income tax kan pek angaih loh avangin PPF a pension tur dah hi chu a trul kher lo, chu ai chuan Mutual Fund te, Insurance company ten Pension scheme atan liau liau-a ansiam ah dah hmak a fuh zok. PPF interest rate hi 8%p.a chiah ala ni zui. Hlawk lo lutuk!!

Khitiang Mutual Fund, Insurance company pension scheme te khi Long term a nih avang hian a him thawkhat. investment (stock market thru) chu a ni ngei maia, mahrawhchu long-term anih miau avang hian a hlauhawm hran lo.

Hlauhawm ni se NPS (New pension scheme) hi sorkar laipui hian hman turin an pass kher lovang, chutah tuna hmanlai mek thlak vek nana a buatsaih a ni zawk za mah.

Tuna ka sawi zawng zawng atang khian han chhut vang vang la, i pension hunah fate leh chhungte tibuai miah lo turin I khawlkhawm tling dawn em?. Upat tawh lamah chhungte laka inthlahrun ngai miah lovin nunkhua i hmang thei angem? Dam lohna i tawk thei, chhungte pawisa khawnkhawm chuk chuk te angai angem? Retired tawh lamah rilru engthawl taka awm hi i chak ve thin ang tiraw?

Tun atanga lo plan lawk hi a fuh ber. pawisa thawh in ang theuh theuh a hma thei ang bera dah hi a fuh thlawt. Compounding power anti maia, Entirna bawkin sawi leh ang

Kum 26 i nih atang thlatin Rs.500 i thawh ta a, Interest rate 8% ah. kum 58 ( retirement age tlangpui) ah chuan Rs.8,86,978/-

Kum 42 i nih atang thlatin Rs.1000 i thawha, interest rate 85 ah. Kum 58 a i khawlkhawm tur chu Rs.3,87,209/- chiah a ni Han en vang vang la, In pawisa hman zat chu a in ang chiah. A khawlkhawm hmasa sa vannei a ni mai.

I pawisa khawlkhawm sa, I pension tawh hnu lama lo pe char char tur che hian Annuity te anla awm leh cheu bawk. Sawrkar pawh hian an hnathawk te an damchhung a pek theihna pawh hemi Annuity thru tho hian a ni. Annuity bik chu ni danga sawi atan dah mai ang. Insurance ah Thih hma i venga, Annuity ah chuan dam rei i veng (i dam rei nanana chuan mamawh i nei ve zel, income i nei tawh silo). La ti tralh teng 😀

Short term Debt

He short term debt hi pawisa mamawh thut theih, tam tham si thla 1 emaw, thla 2 leh thla 3 chhung lo dah zawk nana hman a ni. A awmzia chu kan pawisa te hi Loan angin sawrkar (Central Sorkar &State sorkar), company leh Deptt. Lian te hnen ah an pawisa mamawh zual lo phuhruk nan an puk ta thin a ni. Heng bakah hian money market an ti a, Certificate of deposit, treasury bonds, commercial paper etc ah te an dah bawk. A risk involve hi chu a interest rate tla hniam thei hi a ni deuh tawp. A tlak hniam ber ah 6% p.a vel ani tlangpui. A sang lamah hi chuan a tlangpui in 12-17% p.a vel an hawlh phak thin bawk.

A interest hi kum khat bi emaw, thla khat, quarter khat emaw a chhiar lovin nitin angin an chhiar ta zok thin a, kar khat lek dah pawn kan interest hmuh tur ang kha kan hmu ngei ngei thin a ni. Rs. 1 crore dah tling lo te tan hian thla 3 chhunga an capital zong zong nena an withdraw chuan 0.25% te an charge ve thin, hemi charges a hi chu company a zirin a tlem in a tam thei. A then charge miah lohna company te pawh a awm ve tho bawk. A tir dah luh senso ( management expenses) atan hian 2.25% vel an charge ve thin bawk. Hei pawh hi company a zirin a tlem in a tam thei bawk.

Kan va dah theih dan chu hetiang interest rate pe tha leh la pe tha thei tur te lo zir chianga, Govt. policies te nen lama lo zir chiang chunga company indin Mutual Fund ani thin. Mutual Fund tih hian company share investment ngawr ngawr hi an khawih bik lova. A then hetiang ringawt buaipui na Fund te pawh a awm ve leh zel a ni. A thenin Monthly Income Scheme an tia, thla tin an interest rate hmuh an gang pe chhuak in an thawk a, a then company share ringot a invest kum tam tak nghah ngai te anni bawk. Fund hi chi hrang hrang 300 chuang teh meuh India ramah hian a awm a ni.

Mutual Fund (short term debt) enkawl tute pawh hi 30 chuang daih an awm bawk. An performance a zira pawisa lo dah na tur zir chian vet e pawh angai ve thin bawk.

Pension atana an pawisa dah bakah ah hian mamawh thut theih (vanduaina tawk te) lo cover zung zung nan emergency fund hi employer ang te chuan an neih ngei a ngai awm e. Chuan a vanduai tawk te atang khan an recover leh ta mai thin a ni. Insurance or pension sheme atanga an dawn tur atang khan anlo cut sak leh ta zawk thin a ni, emergency fund atanga anlo pek chhuah tawh pawisa kha.

Saving A/C nge Short term Debt tha zawk lo tehkhin ila;

1. Saving a/c ah chuan 3.7 approx% p.a chiah ani. Short term Debt ah chuan a chhe berah 6% p.a, a tha lamah 12-17%p.a

2. Saving bank ah hian charges a awmlo nanga a return hi a chhiat em avangin Short term debt atluk lo. A chhan chu STD(short term debt) ah hian 2.25% pawh lo charge se, an interest rate pek hi a tlem berah 6% vel a ni ta a, ala return theih chu 3.75%p.a ala nit a tho tho.

3. Saving a/c atang chuan a ni la la in sum hi lakchhuah theih nghal a ni. STD ah ve thung chuan online transaction a nih chuan ni 3 vel angai thin. Tin, holiday ah transfer theih a nilo bawk. Cheque atanga dawng tur pawn ni 3 chhungin cheque an release ngei bawk ang, kan va dahna Mutual fund te khan.

Pension Tha Mi?

1st May, 2009 atanga Employees zawng zawng tana hman tawh tur New Pension System hi lo bih chiang dawn teh ang:

1. Pension atan an pawisa thoh khawm te hi Sawrkar fund(Govt. Securities) ah chauh dah tawh lovin Equity, Govt. Securities leh Debt Market (Loan ang chi) ah te dah tawh tur a ni.

2. Equity (Company Share) hian 50% a hauh tawh dawn avangin pension kan lak theih chin hi tam zawk hle tawh tura a ni.

3. Tuna Interest rate hman lai hi 8% p.a ani mek.

4. Pension Account hi Non-Withdrawable leh Withdrawable awm tura duan a ni.

5. Pension pawisa thoh tute (Employees) ten an pawisa dahna tur company an thlan a ngaih tawh dawn avangin(Equity bik ah) Adviser emaw anmahni in hriat thiam chin an neih angai ve hle tawh bawk ang.

6. An pawisa dahna tur thlan ngaihna hrelo te tan Auto Choice Option awm tur ani bawk.

7. Tuna Central Employees bik te hman mek NPS(New Pension System) hian Average in 14.5 % per annum a return. Equity in 50% a hauh hunah chuan anni Pension poh hian atam phah hle tawh tura ngaih a ni.

8. Pension pawisa hi Fund Manager (Mutual Fund Manager ang chi) ten an enkawl tawh dawn avangin company share-a invest mah ni se a him thokhat hle.

9. Pension Fund Regulatory and Development Authority (PFRDA) in an an regulate bawk ang.

10. Fund Manager tur te hi, SBI, UTI Asset Management, ICICI Prudential Life Insurance, Reliance MF, IDFC Mutual Fund and Kotak Mahindra te ani hrih phawt.

11. Contribution zat tur hi minimum ah Rs.500 per contribution. Kum khat ah a tlem ber atan Rs.6000/-. Kum khatah a tlem ber atan 4 times transaction phal a ni. A awmzia chu vawi 4 installment tala tih tur. Hetiang transact/contribute lo te chu kum tin Rs.100/- chawi tir anni ang.

12. Sawrkar hnathawk tan Withdrawable a/c zok open chuan contribution an nei thei lo. Tuna GP Fund etc ah hian thlatin hlawh 10% an chhunglut tur ania employees te hian, sawrkar in an dah zat chiah hi a contribute ve thin. Hetiang sawrkar lam atanga contribution hi withdrawable ah a awm toh lovang.

13 Kum 60 tlin hmaa withdraw chuan 80% hi annuity ah dah ngei tur. A bak zawng 20% hi a hlawm in anla chhuak thei ang. Kum 60 hnu ah erawh 40% hi annuity ah tho dah tur. A bak 60% hi a hlawmin alak theih.

Internet Banking

Mizo ten kan la hmelhriat tawk lo hle. A tangkaina leh a hman dan tlangpui lo sawi ila;

- Account balance check zung zung nan a tangkai

- Cheque order/clearance a check zung zung theih

- Hlawh nei tawh, Mizoram leh hmuh danga pawisa thawn ngai te tan a tangkai hle bawk

- Pawisa thawn man hi RTGS/NEFT tang anih chuan Rs.5 per Rs.1,00,000/- chiah a ni.

- Term Deposit account direct in a hawn theih.

- Internet Banking neih/apply man hi a awm hranlo, free of cost a ni bawk.

- Tax pek nan thil tangkai tawp a ni.

- Mahni mobile recharge nan a tangkai hle bawk, dawr inkhar tawh/emergency ah thil tha tawp ani.

- Rail ticket/Air ticket lei nan agent hlep tur kha mahniin kan help keuh thei.

- Online a thill lei nan, credit card kher an phut tawh lo, Internet banking atanga pek theih chuan an pawm tlangpui tawh.

- Fimkhur erawh angai hle. Website chiangkuanglo leh hriat ngai vak lo ah chuan luh mai mail oh a him ber.

MOTOR INSURANCE

Motor Cover te:

1. Private cars

2. Two Wheelers

3. Commercial Vehicles

Insured’s Declare value: Heihi motor kum 5 chin hnuai lam te, an company rate(leina zat) atanga chhut tur a ni. Depreciation an tia, kum 5 chhunga a hlutna tlak hniam dan atangin an chhut tlangpui. Amaherawhchu, tunlai ah tuman Insurance tel lovin motor public road an an khalh theih toh loh avangin (LAW ani tawh) a hlutna hi chu atir ah an siam fel tlangpui tawh. A company rate ang khan an siam tihna a nih chu.

Terrorist vang te, Riot, Strike leh lirnging etc. vanga motor in a chhiat phah chuan a cover tel vek bok a ni.

Rukru in motor part emaw, anlo tih chhiat hian Motor Cars ho hi automatic in a cover veka, chuan 2 wheeler tan chuan 3% of IDV (Insured’s declare Value) an pek belh angai. Lamp, Tyre, mudguard, bumpers etc te cover tur hian premium tlem azawng I pek belh angai a nia. I car/bike te a chhiat hlawmhlak a, phurh sawn man te pawh hi a cover vek bok.

Policy hi 2 a awm a:

1. Liability Only: heihi mi pawi I sawi( I motor vangin) chiah a cover. Mi pawi I sawi theih hi, I su hliam thei, I su hlum thei, an bungrua I tichhe thei bok.

2. Package Policy: Heihi chuan mi pawi I sawi leh I motor ngeiin a chhiat phah kha a cover ve ve.

I motor a mi I su hlum anih chuan a cover amount hi bithliah a awmlo, Nuaih chuang fe pawh I pek angai mai thei, anih loh pawn mi 3-5 te pawh a rualin I su hlum thei, Insurance company hian a pek sak vek ang che.

Mi bungrua I tih chhiat ( I Motor vangin) chuan heng zat hi Maximum cover Insurance company in an pek sak tur che a ni.

1. Commercial vehicle, 3 wheelers, Taxis, Private car ————- Rs. 7.50 lacs

2. Two wheelers —- ——————————————————–Rs. 1 lac

I motor in a chhiat phah chuan, 75% hi a chhiat chuan avaia chhe vek anga chhut a ni. A omzia chu a thar man or IDV(Insured Declare Value) kha an pe ang che I insure na company in. I Car/Bike etc a bo daih thei, a awmna chen hre miah lovin a bo hlen thei, heihi TOTAL Loss anga ngaih a ni bawk. Mahse Police pawmpuina, a bo ngei a ni tih an finfiah na I mamawh ang. I motor a chhiat in a rem chang chang ah siam tir ngawt suh. Repair garage lian tham leh rintlak ah chiah I siam tir dawn nia ( a phurh sawn man a cover tel ka tih toh kha). A chhan chu insurance company hian an ron verify tlangpui, chuta I buai loh nan.

Deductibles; Heihi Insurance company in I claim an pek tur che atanga anlo deduct ve thin ani.

1. Excess: excess amount thleng hi insurance in an pe loving che. Excess amount hi document ah an ziak thin ang. Excess amount pel chin ah chiah hian an pek tur che ani.

2. Compulsory excess: Heihi a motor insure tu in a pek ve tur a ni. A policy ah a inziak bawk ang. A bang zawng insurancecompany pek tur tho.

3. Franchise: heihi chu claim ten au te t even nana tih a ni deuh ber. A side glass tea lo keha, a nazawngin I claim thei ngot biklo. Amount zan anziak ang, chumi pel chin chiah chu anpe ang che.

Claim an pawm loh ho:

1. Contract thila I motor I hman hawh/hman sak in an pe theilo che.

2. A ngai ang chiah a I tih chhiat leh in( ahma in cover man anpe tawh che a). An pen awn theilo che tihna.

3. Mechanical Breakdown/ electrical vangin an cover theilo bawk.

4. Zurui/Damdawi rui chunga I khalh tih an hriata, accident ilo tawk a nih vaih chuan ngairawh an cover lul loving che.

5. Triau chhak lam (Rihdil) vela I han chesual deuh kher a nih chuan cover ini lo bawk.

6. Tin, Driving License nei lovin an khalh a, anlo chetsual hian cover a nilo bawk.

Motor neitu pa in chetsual na alo tawka, hetah hian Liability Only leh Package ah cover ve ve a ni. An cover theih zat(Sum Assured anti) chu

2 wheelers ah – Rs.1,00,000 thleng

Cars/commercial Vehicles- Rs.2,00,000/- thleng

Tin, I driver tan pawh cover hi I nei thei, premium tlem azawng chu I pek belh angai ang. An cover sak theih zat chu Rs. 2 lacs tho.

Premium an discount sak thei dan hrang hrang te, Eng music system tem emaw ilo vuaha cover tir tho dan te chu sawi duah tohlo mai ang, a thui lutuk tawh. Motor in min sut ten emaw, kan bungrua/ property an tih chhiat te hian chawi tir ngei ngei tur. A mizo taka in ngaihdam hian Company chiah an hlok.

Mizoram sawrkar hnathawk Pension thar tur

Mizoram sorkara defined contributory pension scheme (DCPS) hman ve Cabinet chuan an rel a; hei hian sorkar laipui hnuaia hnathawk pension hlawh pe tawh loin, anmahni’n percentage anga pawisa chhûng lutin, sorkarin a do lêt bawk ang a, an pension hunah sorkarin sum seng teuh tawh loin, pawisa tam tak an la rût thei tura ngaih a ni. He dan hi September 1, 2010 atanga Mizoram sorkar hnathawk nghette tana hman tura a ni ang. (Source: Vanglaini.org)

Enge DCPS chu?:

Tuna Mizoram sawrkar in a hman mek Defined Benefits Plan (DBP) ah hian pension dawn tur zat hi hna an zawm tirh atanga duan lawk ani thin, Defined Contributory Pension Scheme (aka. Defined Contribution Plan) ah thung hi chuan bithliah lawk (Fixed) a ni ve lo.

A awmzia ni ta ber chu, Contribution Plan hman chuan tuna pension an dawn thin zat aia tam daih an dawng theia, aia tlem pawh an dawng thei tho, an pawisa khawlkhawm leh a pung hmuh ang ang kha an pension dawn tur a ni tawh ang.

Pawisa thawhtu (sorkar hnathawk) ten anmahni in interest risk an lak a ngai toh dawn a, Stock Market etc. ah return an hmuh that chuan pension pawisa an dawng hnem ang, hmuh that loh chuan tuna an dawn thin aia tlem hi a dawng a ngai tihna. Tin, sawrkar hna, rokhawlhna avangin rei thawk thei lo se, an pension dawn turin a tuar tawh dawn bawk a ni.

Sawrkar tana a thatna:

Sawrkar (Mizoram Govt.) tan chuan a khawiti zawng pawn Contribution Plan hi a tha zawk. A chhan chu, sum tam tak a save theih tawh dawn avangin. Tuna hmanlai mek Defined Benefits Plan-ah hian miin sawrkar hna a rawn zawm tirha an pawisa rawn thawh zat atanga chhuta sawrkar in a doletna (sorkar contribute pui) hi Govt. bonds, Treasury notes etc. lei nan an hmang thin a ni.

Hetah hian sawrkar-in interest a hmu tha teh chiam ngai lo, an pension pek tur zat hi 8.5% p.a. vel a ni a, hemi zat interest hi a changin a hmu a, a changin a hmu phalo thin (Synod buaina ang chiah). Pawisa a zuk deposit-na hi Bank te angin fixed return a ni lo, kumtin a danglam ve thin a ni. (Tun dinhmun ah pension atana pawisa tlingkhawm hi stock market ah 5% tak ngial pawh dah an rem ti lo Provident Fund Board in).

Heta interest a hmuh that loh chang hian sawrkar in pawisa thawh belh sak a ngai ta thin a (pension pek tur zat bithliah lawk a nih avangin). Interest hmuh that chang erawh chuan a thawhpui zat a hniam veleh thung thin. Heng bakah hian hetianga pawisa thawhpui ngaizat lo chhut tur hian sawrkar in Actuary a ruai thin, hemi te rawih nan pawh hian sum tam tak a seng thin. Tuna an hman tur Contribution Plan ah chuan Actuary rawih a ngai tawh lovang.

Employees tana a thatna:

Stock Market ah pawisa an duh zat an invest tel theih tawh dawn a, an pawisa deposit chhung tur hi an sawrkar hnathawh chhung zawng kha a ni. Stock Market-ah hian pawisa dah rei poh leh risk a tlem tial tial thin a, tuna an dahna ve thung Govt. Bonds etc. ah thung hi chuan an dah rei poh leh risk a tam tial tial ve thung, dah maia. Stock Market nen a in opposite chiah a nih chu. Chutah Sawrkar hnathawk ten an service chhung (approx. 33 yrs)pawisa an dah thin avangin Stock Market hi a thlanawm zawk hle. Tun dinhmun ah India ram bikah chuan Stock Market average return hi 15%-25% p.a. vel a ni.

Tin, kum 10 chhunga pawisa return hi Stock Market tluk tu anla awm lo, India ram maiah a nilo, khawvel pum ah a ni.(chiahpuam anga puam trual trual kha khoi ramah mah i nei reng thei ngai lovang)

Entirna nen lo dah ila: I thla hlawh atangin Rs.1500 thlatin i pension (GP Fund) ah lo dah thei la, tuna pension hman lai mek ah hian, an service zawh huna an lak theih zat tur chu: Rs. 32,53,651/- a ni. (Service Year – 33 Yrs)

Pension thar hman tura return theih zat ve thung chu: Thlatin Rs.1500 pension atana dah in leh kum 33 hnuah – Rs. 1,63,09,103 (Heihi Stock Market Lower Average Return 15% p.a.)

Stock Market Higher Average Return (25%p.a.) ah ve thung: Rs. 25,31,20,121/- (Are yaar Crorepati)

Langtlang pension ani tawh ang, tuna hman mek ah hi chuan i pawisa chhun luh ve te kha i GPF ah bak an lut lova, i pension pawisa tak hi chu sawrkar thawhpui ve che atangin a ni zawk. Hetah hian engzat nge in khawlkhawm tawha, engzat nge a pung te nen ni tawh tih i hre thei mai thin lo, a thar ah hi chuan engzat nge pension atan i lak theih tur i hre zung zung tawh ang.

Employees tana a that lohna:

Khiti zata tam sum leh pai hmuh theih tak avang khian lo nui vur vur suh, hei chanchintha ni ve chiah lo chu: Tuna pension hmanlai mek Defined Benefits Plan-ah hian, i hlawh hmanga i khawsakna level (standard of living) mil tura pension hi siam a ni. Thil man to tak avang te, mihring dam hun chhung rei tak avang te a i tuar lohna tawk tura pension sum hi pe thin che an ni. Fixed a ni kan tih tawh kha. An pension dawn tur zat hi pension-a an chhuah dawna an hlawh zat mila siam rem thin a ni (Formula a awm)

Stock Market atang khian khiti zat interest rate khi i hmu ngei ngei dawn e tihna a ni lo, engpawh a thleng thei he khawvel ram zau ah hian. Risk i la tel ta tihna a nih chu, a hma zawnga risk lo awm thin kha chu sawrkar in a hmachhawn maia, tunah chuan nangman i hmachhawn a ngai ve ta tihna.

Kum upat tawh hnu a sawrkar hna vuan te tan a hlawk teh chiam lo, a chhan chu an pawisa khawlkhawm leh an interest hmuh ang ang kha an pension dawn tur anih tawh avangin.

Tha zawk ni a ka hriat chu….

Security tha zawk hi duhthusam chu a ni, Defined Benefits Plan-ah khian risk a awm lova, i dawn tur zat chu matheilovin i dawng dawn, contribution plan ah ve thung chuan i dawn tur zat hi a chiang tlat lo, chuti Defined Benefits Plan chu a tha zawk tihna em ni… ???

Contribution hman khian i tawrh theih te chu: (1) Stock market tlahniam vak, (2) service rei hman lova ilo boral emaw, vanduaina ilo tawh palh tak in, (3) kum upat hnu a service i zawm in. Anih hengte hi Risk Management hmangin kan paih bo thei angem?

Kan paih bo theih dan chu, Stock Market tlahniam vak khi, sorkar fund leh company stock te contribution siamin engemawchen a tih bo theih. A chhan chu Stock market chhiat laiin sorkar fund ten an return tha thin, chutiangin stock market that lain sorkar fund ten an return chhe ve leh thin!

Anih service rei hman lova ilo vanduai in? Heipawh hi Insurance + Investment hmangin a paih bo hmak theih. ULIP lak hian a claim lamah harsatna namai lo tak a thleng chawk. Mahniin Company stock leh Term insurance hman kawp mai a fuh hmel (Hetah hi chuan angaihna hria te rawn mai a tha).

He pension fund thar tur hi sorkar tan thawkhuai na tham a nih bakah a dawng tur te 90% zat aia tam mahin an hlawkpui dawn avang in, a tha zawk mai lawm ni? Sorkar hnathawh laia vanduai, pension sum khawlkhawm thahnem hman lo tur te chu, service kum 10 poh nei tling lo te anih a rinawm a, heng mite hi 10% an tling lo torah ka ruat ve tawp, dik tak maw??

Kum upat hnu a service zawm khi chu han tih dan vak avang hle in a hriat, Kristian ram te kan ni bawka, kan tawngtai pui mai dawns?

2 comments